Republic of the Union of Myanmar

State Administration Council

Law Amending the Union Tax Law 2021

State Administration Council Law No. 1/2022

5th Waxing of Pyatho 1383 ME

6 January 2022

The State Administration Council hereby promulgated this law under Section 419 of the Constitution of the Republic of the Union of Myanmar.

- This law shall be named “the Law Amending the Union Tax Law 2021”.

- This law shall be affected from 8 January 2022 to 31 March 2022.

- Sub-Section (e) of Section 14 of the Union Tax Law 2021 shall be substituted as follows:-

“(e). Five per cent of commercial tax shall be levied over the income of other services being operated at home, except services mentioned in the Sub-Section (d) and Sub-Section (e-1).” - The following section shall be inserted as Sub-Section (e-1), under Sub-Section (e) of Section 14 of the Union Tax Law 2021:-

“(e-1) (1) No matter what provisions the Commercial Tax Law comprises, only once commercial tax shall be levied K20,000 per the sales of SIM cards and SIM card activation.”

(2) Fifteen per cent of commercial tax shall be levied over the income

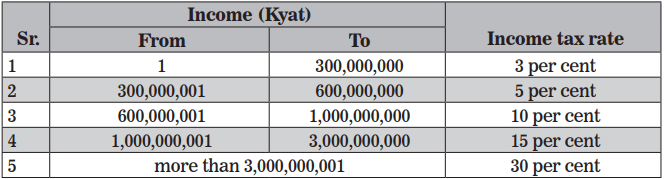

earned from the internet services.” - The table of Sub-Section (a) of Section 25 of the Union Tax Law 2021 shall be substituted as follows:-

I hereby signed it under Section 419 of the Constitution.

Sd/Min Aung Hlaing

Senior General

Chairman

State Administration Council

Source: The Global New Light of Myanmar